Should You Be Faced With a Crisis

Review crisis management examples to acquire from others' experiences with this comprehensive collection of case studies. Examples are organized by theme, and include crisis management successes and failures.

In this article, find crunch management examples organized past best practice, five of the costliest crises ever (and what was learned), and examples of companies that have built the world'due south almost valuable brands past safeguarding their reputations.

What Is Crisis Direction?

Crisis management refers to the practice of preparing for negative incidents, minimizing their damage and disruption, and getting an organization back on track as quickly as possible. Crunch managers anticipate likely threats and develop strategies to cope with their touch on. To read more nearly crisis management please visit our "The Essential Guide to Crisis Management" article.

Encounter how Smartsheet tin help you exist more constructive

Sentinel the demo to meet how yous can more effectively manage your team, projects, and processes with existent-time work direction in Smartsheet.

Watch a free demo

Effective Crunch Management Examples

Constructive crunch management occurs when an organization employs skillful planning and a proactive response to avert a crisis entirely, limit its severity and duration, or plough information technology into an opportunity. These examples characteristic organizations that responded with transparency and agility.

CPG Product Crunch Direction Example: Tylenol Product Tampering

In 1982, seven people in the Chicago area died after taking Tylenol capsules poisoned with cyanide. The tampering was believed to have occurred when someone injected the chemical into capsules and returned them to store shelves. The deaths remain unsolved, but the way Johnson & Johnson handled the episode has go a teaching case report for effective crunch management at Harvard Concern School and elsewhere. In 2003, Fortune mag named James Burke, the company'southward CEO at the fourth dimension, as one of history's greatest CEOs for the way he handled the scare.

Beneath are some highlights of Johnson & Johnson's handling of the crunch:

- Fast and Decisive Action: According to a volume on the case by Harvard Professor Richard Tedlow, on the afternoon of the kickoff two deaths, the company halted all production advertising, sent 450,000 messages to hospitals, doctors' offices, and other stakeholders, and established cost-gratuitous hotlines for consumers. At a cost of more than than $100 million, the company recalled all products from shop shelves — 1 of the commencement nationwide recalls — even though authorities officials felt that doing so was excessive. Additionally, Johnson & Johnson issued warnings to consumers not to take its pain reliever.

- Honesty and Integrity: Despite prove that the poison was introduced via store shelves, Johnson & Johnson did non try to evade blame. As a result, Burke was praised for his honesty. His integrity stood out in the context of the mail-Nixon era and the unforthright handling of the 3 Mile Island nuclear disaster. The company became a pioneer in developing tamper-proof packaging, and somewhen moved abroad from capsules to a more tamper-resistant caplet. Burke was candid in expressing regret that the visitor had not done so right away.

In less than a year, Tylenol regained its market share and sales leadership, and according to a BrandSpark report, information technology continues to rank highly for consumer trust.

For a comprehensive look at crisis management in the Tylenol deaths, meet this profile of Burke's leadership and analysis of Johnson & Johnson communications.

Healthcare Crisis Management Instance: Global Pandemic

While the global pandemic that began in late 2019 challenged many organizations, the calamity as well highlighted examples of strong crunch management.

The Cleveland Clinic Abu Dhabi operates as a U.Due south. medical center in the United Arab Emirates. The hospital faced COVID-19 early on in its migration beyond China. The dispensary responded rapidly in order to both expand its emergency capacity and continue providing intendance for cancer and transplant patients, likewise every bit for those with other complex needs.

Dr. Rakesh Suri, CEO of Cleveland Dispensary Abu Dhabi, says that forming a crisis management team (that included individuals from all levels of the arrangement) was a critical step, as doing and so enabled the infirmary to act with agility. The medical center too coordinated with other local hospitals to maximize resources and play to each establishment's strengths.

The executive team took extra steps to accept care of staff, including talking honestly virtually their emotional challenges and providing sleeping rooms, meditation space, online workouts, nutritious food, counseling, and childcare.

An in-depth case written report on the hospital surfaced several lessons, including the importance of preparing for worst-case scenarios, leaders empowering their teams to solve bug innovatively, encouraging artlessness, proactively engaging all stakeholders, and taking care of physical and mental well-being.

In business organisation, companies had to pivot rapidly as the pandemic inverse the marketplace. A 2020 Harvard Concern Schoolhouse study of 350 senior executives in China who faced the crisis early found some cardinal commonalities amid those who managed effectively, including the following:

- Amend conclusion-making by moving away from the hierarchical model.

- Collaborate in new ways with customers, suppliers, regulators, and even competitors.

- Support remote piece of work by irresolute company culture to prioritize trust and results over command-and-control and physical presence.

- Ask employees to cocky-select for challenging assignments in gild to get maximum ownership and motivation.

- Embed new learning and innovative digital strategies that arise in a crisis into your organization'south muscle memory.

Examples of Bad Crisis Management (and What They Teach Us)

In contrast, examples of poor crisis management are usually marked by fundamental errors in preparation or execution of an emergency plan — and sometimes both. Often, these problems compound, which but multiplies the scale of the crunch.

This is especially true in so-called blackness swan events — incidents that are extremely rare, accept severe consequences, and are generally perceived in hindsight to have been obvious to happen. Since the likelihood of a blackness swan event occurring is low, leaders may dismiss the risk (if they are even conscious of it). Merely, the grave consequences of black swan events tin can pose a much larger threat.

Following are real-globe examples of weak crunch management and the lessons crisis managers can take from them.

Natural Disaster Crisis Direction Example: Hurricane Katrina

In August 2005, Hurricane Katrina hitting the U.Southward. Gulf Coast and flooded New Orleans, causing more than $100 billion in property impairment and killing more than 1,800 people. Fifty-fifty though the hurricane began as a natural disaster, the scale of the catastrophe was human being-made. Diverse analyses of the response, including a report by Congress, focused on weak aspects of the crisis management and highlighted the following important lessons:

- Preparation Is Primal: In 2006, a study by the Army Corps of Engineers found that the levees congenital to protect New Orleans from flooding were incorrectly engineered, poorly built, and insufficiently funded. Additionally, government officials who were aware of the storm forecast did non make provisions to evacuate residents who did not have cars or could not afford omnibus fare, which left tens of thousands of vulnerable people stuck in the city. The government also didn't position plenty emergency supplies in New Orleans ahead of the storm.

- Train Your Crisis Team: The Federal Emergency Direction Agency (FEMA) was led by officials who were political appointees and had no experience in disaster management. A congressional review found that agencies handling the response were unsure of their roles and responsibilities. Government agencies failed to learn from a drill of a similar hurricane hit New Orleans the previous year.

- Simplify Communications and Decision Making: Federal and local crunch managers struggled to communicate due to equipment failure and incompatible technologies. Confusion amid dissimilar levels of regime paralyzed decision making. Ultimately, the crunch plan was too complex — with 29 federal agencies playing a function, duties were unclear and also much carmine tape hampered efforts.

- Act Quickly just Not Rashly: About $ii billion spent past FEMA in Hurricane Katrina was wasted or fraudulently claimed, according to a New York Times analysis. In many ways, this was a symptom of a poorly planned and executed crisis response. For example, FEMA ordered $100 million in excess water ice that truckers shuttled around the state for weeks while the agency tried to effigy out where it should get (subsequently storing information technology for two years, the government melted the ice). Additionally, the agency spent $vii.9 one thousand thousand to renovate a former ground forces base as a shelter in Alabama that only 10 people stayed at (the shelter closed within a month). Half of the mobile homes ordered as temporary housing — at a cost of $430 million — went unused.

For in-depth instance study of Hurricane Katrina crunch management, run into "Katrina and the Federal Emergency Direction Agency: A Case Study in Organizational Failure."

Industrial Disaster Crisis Direction Example: Bhopal Gas Leak

In 1984, a toxic gas leak from a Union Carbide India pesticide plant in Bhopal, India killed upward to 30,000 people from immediate and long-term effects (co-ordinate to estimates) and injured about 575,000. The accident is one of the world'southward worst industrial disasters.

The leak was caused by the introduction of water into a chemical tank, which resulted in a heat-generating, delinquent reaction. Several inquiries found evidence of company negligence, just an internal analysis blamed employee sabotage.

Researchers have written extensively about the accident, and some of the lessons cited are universally helpful in crisis management, including the following:

- Rehearse Emergency Procedures: The constitute did not have an emergency plan, and plant operators did not know how to handle an emergency. No effective public alert organization or public education about the risks were in place.

- Prioritize Crisis Readiness: The company reduced training and staffing at the plant to save costs. Supplies of gas masks were inadequate, and several plant safety mechanisms were either deactivated or faulty. Additionally, several experts plant that there weren't enough operators for the unit of measurement to function safely. On the dark of the accident, the supervisor delayed investigating an initial small leak until afterwards a coiffure break, rather than being proactive.

- Share Information: A U.South. Union Carbide constitute institute earlier in the year that a delinquent reaction in the chemic tank could happen, but they didn't communicate it to the India plant. When the leak occurred, plant staff did not inform senior managers or local authorities. Nearly of the information on the chemical involved, including how to treat exposure, was proprietary and was not disclosed. And then, public wellness government and hospitals in Bhopal did not know immediately what victims had been exposed to (and therefore couldn't provide the all-time antidotes).

For in-depth case studies on the Bhopal accident, see Spousal relationship Carbide Corp.'s site defended to the tragedy, as well as "An Analysis of the Bhopal Accident" and "The Bhopal Disaster and Its Aftermath."

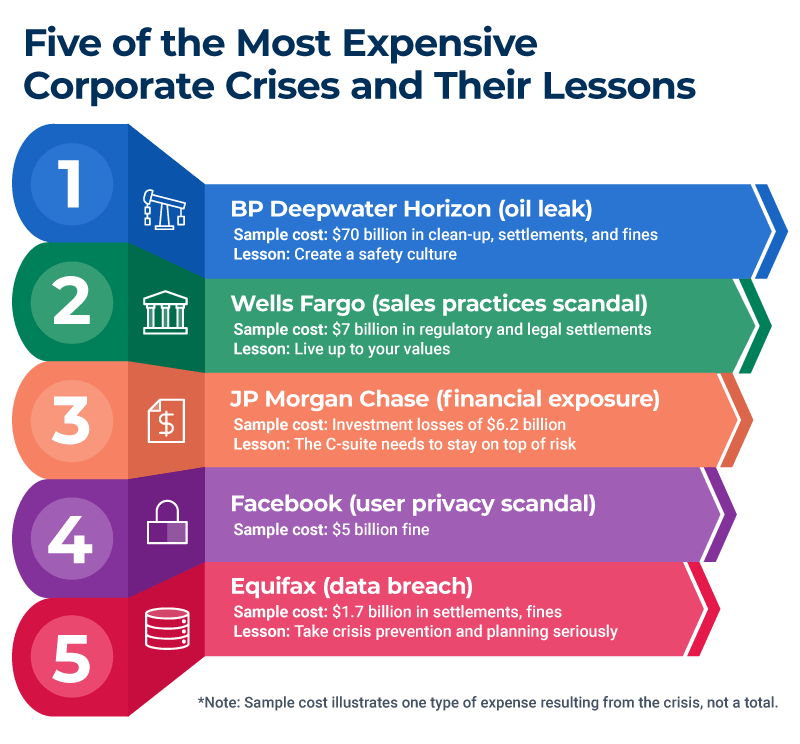

V of the Most Costly Corporate Crises and Their Lessons

In improver to the human toll, a crisis can besides be financially devastating for a company and its shareholders. Aside from straight costs, businesses may face fines, damage claims, legal settlements, damage to brand value, exodus of key revenue-generating staff, competitive disadvantages, and stock price declines.

Social media has compounded these effects. A study by Pentland Analytics that compared corporate crises in 2000 and 2018 found that social media amplified impairment, doubling the loss of shareholder value (from a xv percent to a xxx per centum decline in the starting time twelvemonth later a crisis).

The most costly crises accept multi-dimensional financial impacts. Post-obit are some examples of calamities that acquired extensive financial impairment to the companies.

one. Example: BP Deepwater Horizon

In 2010, BP'due south Deepwater Horizon oil-drilling rig in the Gulf of United mexican states exploded, killing 11 employees and causing an oil leak that lasted for three months. This is the biggest oil spill in U.S. history.

The oil spill devastated the surroundings and tourism. Damage to the environs has been long-lasting — ane written report valued the touch at $17.two billion. The spill also caused billions of dollars in negative economical impact on tourism in the region. Meanwhile, the financial toll for the company included the following costs:

- Through early 2020, BP paid about $seventy billion in clean-up costs, legal settlements, and fines.

- In the ii months later on the spill, the visitor's shareholders lost $105 billion equally its stock toll plummeted.

- For a time, the company's survival was in question. Its bonds crashed in value, and the company had to stop paying dividends for three quarters.

- In the United States, the BP make faced a backfire from consumers, and BP gas stations saw sales drop 10 to twoscore percentage in the immediate aftermath of the spill.

- BP had to reduce its concern spending for years, which analysis said put it behind competitors such as Beat, whose make value rose 24 percentage that twelvemonth, co-ordinate to Interbrand. BP dropped from the second-largest global oil company in 2010 to fourth, where information technology has remained.

Crisis Management Lesson: Create a Safety Culture

Studies accept attributed the blow to a serial of human mistakes and technical failures in the context of a high-run a risk corporate culture and weak regulatory supervision. The studies noted overconfidence on the part of BP, based on many years of not having an offshore well blowout in deep h2o. They besides cite a lack of planning for depression-probability, loftier-impact oil spills.

Operators and managers grew accepted to normalizing signs of potential trouble and ignored weak signals of looming disaster. Warning systems on the rig were suppressed, and crucial equipment was not properly maintained. The Center for Catastrophic Take chances Management at the University of California Berkeley blamed the absence of a safe civilization and shortsighted prioritization of the bottom line. According to the center's report, BP "forgot to exist afraid."

ii. Example: Wells Fargo

For 14 years, until the practice was exposed in 2016, hundreds of thousands of Wells Fargo employees opened customer accounts without consent to meet sales targets and generate fees for the bank. The financial consequences included the post-obit:

- The bank paid more $7 billion to settle authorities investigations and private lawsuits.

- Wells Fargo lost business organization from the country governments of California and Illinois, too as from the cities of Chicago, Philadelphia, and Seattle, among others who cited the illegal beliefs as the reason.

- In response to the scandal, in 2018, the Federal Reserve imposed a limit on the bank's growth, putting Wells Fargo at a competitive disadvantage and costing information technology an unknown corporeality of potential increase in customers and loans.

- The company lost $220 billion in stock market value in the two and a half years after the enforcement action. The stock hit a 10-twelvemonth depression in May 2020, faring far worse than its peers.

- The banking concern has racked upwardly heavy expenses related to the crunch, including legal fees, investigation costs, and spending on an ad campaign aimed at restoring consumer trust.

Crisis Direction Lesson: Live Up to Your Company Values to Avoid Scandals

According to the government, Wells Fargo executives were aware of the abuses as early as 2002, simply failed to deed despite espousing a culture of integrity. The executives imposed such ambitious sales targets for staff that many employees said they felt they had no choice but to engage in the illegal practices. The authorities is pursuing some individual executives for their roles.

For an in-depth discussion, y'all tin can read the total report issued by the U.S. House of Representatives.

iii. Example: Equifax

In 2017, Equifax, a credit reporting agency, suffered a data breach that gave hackers access to sensitive personal data for 147 one thousand thousand consumers. The incident was the near expensive data security breach to date. In 2020, 4 members of China's People's Liberation Army were indicted in the U.s. in the breach.

- The company had $1.seven billion in legal settlements, fines, fees for consultants, lawyers, and investigators, and the cost of providing credit monitoring and identity protection to consumers.

- In the week after Equifax disclosed the breach, the company lost $5.iii billion in marketplace valuation every bit its stock price declined 31 percentage.

- For the first time ever, a credit rating agency downgraded its outlook on a company over cybersecurity concerns. A credit rating downgrade increases a company's borrowing costs. Moody'south dropped its rating on Equifax to negative from stable in 2019, 2 years after the breach, citing connected high costs related to the hack. Moody's further projected that the spending would continue to hurt Equifax's profitability.

Crunch Management Lesson: Take Crunch Prevention and Planning Seriously

A congressional investigation found that relatively basic mistakes at Equifax led to the breach. For example, the attack occurred through a server vulnerability that was a known upshot. Equifax had previously notified its arrangement administrators to patch the effect, just the person responsible for the point of entry did not get the bulletin because Equifax'southward email list was out of date.

An expired digital certificate allowed malicious network activeness to stay hidden. Proper information governance protocols, which limit user access to sensitive information, were not in place — this immune the attackers to run about ix,000 queries to discover the consumer data. The assail lasted almost 76 days before it was discovered.

The company's public response contained many missteps (including directing consumers to a website that had bugs, according to Information technology experts) and equally such, did non inspire confidence. For case, the site asked consumers, who had just had personal information stolen via Equifax, to enter most of their Social Security numbers to detect out if they were included in the hack. The company mistakenly tweeted a phishing link for the response website four times instead of the correct URL, according to Wired magazine.

Crisis management experts said Equifax lacked comprehensive prevention and response plans and faulted the company's slow disclosure. (Equifax discovered the breach in July 2017 just did not reveal information technology until September 2017.) Given the sensitivity of the information in their database, Equifax should have had much more than robust training, experts said.

For details on crisis management planning, encounter "Step-by-Stride Guide to Writing a Crisis Direction Plan." Yous tin can also use ane of these free disaster recovery planning templates to aid get your business back on track.

4. Case: JP Morgan Chase

In 2012, a trader in JP Morgan Chase's London role, nicknamed the London Whale, ran a portfolio of esoteric derivative investments. The trader was part of a team whose mandate was to hedge the bank's operating risks. Merely, the whale'south investment strategies turned out to be flawed, and the size of these transactions was so dandy that they affected world credit markets. The whale's trades ultimately lost money on a massive scale, and the company sustained the following financial impacts:

- Investment losses of $6.2 billion.

- JP Morgan Chase received fines of more than than $ane billion by U.S. and British regulators.

- Senior executives were stripped of $75 million in compensation later an internal investigation.

- The company had to pay one hundred and fifty one thousand thousand to settle a shareholder class action lawsuit.

- A loss in stock market value of $14.four billion in the 2 days subsequently disclosing the problem.

- The company's reputation equally a careful risk director was too damaged. In 2012, research company Interbrand found that the value of JP Morgan's brand had dropped viii pct, to $eleven.5 billion.

Crisis Management Lesson: The C-Suite Needs to Stay on Top of Risk

When he realized the full potential for disaster, the London Whale, whose existent proper name is Bruno Iksil, suggested that the visitor immediately take a loss on the positions. This move would have resulted in much less financial impairment.

But, according to a U.Due south. Senate report, his managers began to muffle the magnitude of losses. They produced a shadow spreadsheet and hoped the investment positions would turn effectually, which resulted in mounting losses.

Reviews of the episode found that hazard-management practices for the division were less rigorous than for other areas of the bank. Get-go, the banking company ignored warning signs from its risk metrics and then changed the risk standards (and so the warning signs went abroad), according to a company report.

Although people internally realized the potential extent of losses, bank management downplayed them in public. In 2012, CEO Jamie Dimon dismissed the incident as a "consummate tempest in a teapot," the Senate report said, a position he would later reverse.

The bank'due south investigation plant that at that place was also niggling scrutiny of the London activities by its height management. In the aftermath, the banking company strengthened take chances management and made the review squad more contained to accost the group-think mentality that express questioning of the investment strategy, JP Morgan said. The episode sparked calls for tougher regulation.

five. Example: Facebook

In March 2018, a whistleblower told two newspapers that a British firm called Cambridge Analytica had bought data near 87 one thousand thousand users and their friends without their consent from Facebook. The company used the data to build voter profiles that Cambridge sold to election campaigns, including Donald Trump's presidential run.

The episode sparked a scandal over user privacy at Facebook, the biggest of many. CEO Mark Zuckerberg was called to testify before Congress. The company faced investigations by regulators in the United states and Britain, besides as lawsuits from several jurisdictions.

The financial repercussions included the following:

- The U.Due south. Federal Trade Commission imposed a $5 billion fine against the company — the largest ever. The FTC said Facebook's behavior violated a previous consent prescript with the bureau. The Securities and Exchange Commision fined the company $100 1000000 and British regulators fined 500,000 pounds.

- Engagement on Facebook dropped by 20 percent in the months afterwards the scandal, a metric that affects the company's ad revenue.

- Facebook users' confidence in the company dropped 66 pct in the weeks subsequently the scandal broke and Zuckerberg testified before Congress, according to a Ponemon Institute survey. Some users quit Facebook (including 3 million Europeans) in the subsequent months over privacy abuses. The hashtag #DeleteFacebook began trending on social media, and public support for tighter regulation of social media grew.

- Growth in Facebook revenue and users dropped in the quarter after the Cambridge Analytica matter. The company'southward stock valuation lost $130 billion in two hours afterwards the news, weakening the social network'south forecast farther.

- Facebook sustained a drop in make value of 6 percent (about $two.9 billion) for the year to $45.2 billion, according to Interbrand.

Crisis Direction Lesson: Apologize When Yous are Wrong

U.S. investigators found that Facebook violated consumer trust by allowing a 3rd party to collect users' personal data without their noesis. The data collectors also violated Facebook policies that required deleting the information.

Facebook CEO Zuckerberg was silent for five days before issuing a statement acknowledging that mistakes had been fabricated. Facebook users heavily criticized the response, prompting Zuckerberg later to say, "I'm lamentable" in media interviews. Information technology experts said the response was slow and underwhelming.

Critics faulted Facebook for technical decisions that resulted in app developers being able to access data about users' friends, saying safeguards were inadequate. Commentators such every bit Tufts University cybersecurity expert Susan Landau also criticized Facebook for not taking legal action against Cambridge Analytica and for failing to inform users whose data was taken until well later the news bankrupt.

The company placed total-page newspaper ads, made changes to data-treatment practices, and implemented other reforms, but consumer trust remained damaged. Analysts said Facebook's gestures, including its lack of apology, rang hollow and came too late.

All-time Crunch Managers Safeguard Their Brands

Protecting your reputation is an of import attribute of crisis direction, and conveying authenticity and empathy is paramount when anyone is harmed.

Reputation inquiry firm RepTrak institute in a 2020 survey of 80,000 consumers globally that corporate responsibility (made up of workplace quality, governance, and corporate citizenship) accounts for 41 percent of its reputation. (For details on how and when to apologize, meet "Models and Theories to Amend Crisis Direction.")

Corporate reputation is an of import influence on consumer behavior. RepTrak data shows a company with an excellent reputation activates willingness to purchase among 79 percent of consumers, compared to 9 percent for companies with poor reputations.

Companies that maintain strong reputations through the decades are typically examples of strong risk and crisis management. But that is not to say they have necessarily avoided all calamities: sometimes, these organizations have faced a pivotal crisis and turned it into an opportunity to accomplish long-term reputation strength.

Reputation is the principal determiner of make value, which is a visitor asset that can exist worth billions. Interbrand found that the value of the top 10 global brands in 2019 was collectively about $1 trillion.

Top 10 Virtually Valuable Global Brands*

- Apple: $234.2 billion

- Google: $167.7 billion

- Amazon: $125.3 billion

- Microsoft: $108.9 billion

- Coca-Cola: $63.iv billion

- Samsung: $61.1 billion

- Toyota: $56.2 billion

- Mercedes: $50.1 billion

- McDonald's: $45.three billion

- Disney: $44.iv billion

*Source: Interbrand, 2019

Crisis Management Examples past Best Practice

Crisis example studies help illustrate all-time practices and how companies apply them. The following examples evidence how crisis management leaders and laggards performed on fundamental best practices in specific situations.

Crisis Management All-time Practise: Form a Crisis Team

While you should have a designated crisis management team, you may also demand smaller teams focused on particular issues. Cantankerous-functional teams are ofttimes peculiarly effective. Free team members from their normal duties while they are handling the crunch, remove constraints, and give them the resources they demand, such equally specialized external experts. When the crisis is over, review the team's performance. (For more about crunch direction teams, see "How to Build and Effective Crisis Management Team."

Example: When Volkswagen faced a crisis over its diesel-emissions scandal, Oliver Larkin, group head of investor relations, told IR Magazine that the company "immediately put in place a task force team, with representatives from the communication side but also from the technical side and the legal side evaluating the information every bit it was coming through – and those people were working 24/7." The group'southward focus was on messaging, VW's reputation, and relationships with major investors, and other responsibilities were put bated. Specialists, who were situation consultants, also joined the effort.

Crunch Management Best Practise: Take a Plan

Hopefully, your crisis direction plan includes a communications plan that you've detailed in advance. But if not, or if yous disregarded anything relevant to the crisis at hand, exercise some quick planning at the offset of the crisis. Brand sure to program for social media, and draft holding statements. To learn how to write a program, read "Step-by-Step Guide to Writing a Crisis Management Programme."

Examples: In a case study of what not to practise, Amazon faced negative attending around its 2019 Prime Twenty-four hour period shopping promotion. Staff effectually the world protested over alleged poor working atmospheric condition and abusive visitor policies. Actions leading upward to and on the day sparked media coverage, calls for legislative activeness, and belatedly-dark Television set segments. Amazon did not annotate publicly, defying public relations all-time practices. PR experts speculated the company did not have a crisis communications plan to mitigate the damage.

Every bit an example of strong crisis communications, the American Federation of Government Employees, the union representing 700,000 employees of the U.S. federal government, responded to the coronavirus crisis with a multi-pronged communications plan. The goal was to draw attention to concerns over a shortage of protective gear and testing, policies, and short-staffing.

The union sued the federal government for hazard pay, and so targeted private agencies by publicizing the plights of their staff to the media with printing releases, TV appearances, and a daily newsletter. Internally, the union sent daily email alerts and digital campaigns to local leaders, weekly updates to members, mass texts, and memes to get the word out.

Crunch Management Best Practice: Pick the Right Spokesperson

Cull an individual who has the cognition and training to address the crisis and is in a position of potency. Yous can coach the right person on working with the media, but putting a representative who lacks expertise in front of the cameras will backfire: your organization will come across uninformed or incompetent.

Example: During the coronavirus pandemic, Dr. Anthony Fauci, Director of the National Institute of Allergy and Infection Diseases for more than than 30 years, brought expertise to his role as explainer in master to the American public.

He conveyed the importance of citizens staying home with clear and consistent messaging, and he deftly handled complex questions about science from the media. He gave interviews on social media, podcasts, sports shows, digital news sites, as well every bit traditional media, to reach all demographics, including teenagers.

Crisis Management Best Do: Be Present

In a serious crunch, leaders should always be on site, either at headquarters or the location that makes the most sense. Cancel business trips, and render from vacations.

Example: In early 2020, wildfires burned more than than 20 pct of Australia's forests and killed 26 people. During the disaster, Australian Prime Minister Scott Morrison faced an outpouring of anger from citizens and intense media criticism after secretly taking a Hawaiian vacation and having his staff deny it.

The prime minister'south representatives refused to disembalm his location, igniting a social media tempest and dominating media coverage. Then, an Australian tourist shared a photo he snapped with the leader on a Hawaiian beach. The authorities had to backtrack, which acquired huge embarrassment and a scandal about the camouflage.

Crisis Management Best Practice: Respond Speedily

Result a statement inside the start hour of a crunch and publish frequent updates. Keep customers and other stakeholders informed about progress. If y'all're unsure well-nigh frequency, err on the side of too much communication, rather than too petty.

Example: In 2018, afterward switching delivery companies, Kentucky Fried Chicken (KFC) suffered supply issues that caused a shortage of craven at its U.Chiliad. restaurants. The company was forced to close more than two-thirds of its locations.

Even though the crisis response group initially had niggling information about the problem, the team quickly acknowledged the result publicly. Inside hours the squad explained what had happened, how it was beingness addressed, and when it would be solved.

"Our instinct was that we had to face the issue head on: a chicken restaurant without craven. Not ideal," a spokeswoman for KFC told Raconteur at the time. "We were responding live as we received new information. We acted fast in assessing the event and working out the best arroyo."

In a negative case study, General Motors in 2014 did a serial of vehicle recalls due to faulty ignition switches that affected 30 million cars. The company ultimately paid about $four.1 billion in repair costs, victim bounty, and fines.

But mayhap fifty-fifty more dissentious was the revelation that the automaker had known about the problem for at least a decade, at one point blaming the fault on curt drivers and heavy key chains. The resulting publicity and congressional hearings harmed GM'south reputation, and ane senator described the company as having a "culture of cover-upwardly."

Apply a crisis communications strategy template to assistance you assign important responsibilities and build a process and response plan in the early stages of a crisis. For all other crisis direction templates please visit our template article. You can also acquire about step-by-stride instructions on how to build a strong crisis management strategy, including gratuitous templates and tips from experts.

Crisis Management Best Practice: Be Compassionate

Respond empathetically to show that your organization cares about people. Fear of lawsuits ofttimes causes companies to resort to carefully parsed legal language or caution. While minimizing liability is important, showing your man side goes a long way to winning goodwill and defusing acrimony, which oft is a motivating factor in lawsuits.

Example: In 2019, Boeing responded to news that its 737 MAX airplane had caused two crashes and killed 346 people due to faulty software by insisting the shipping was prophylactic and that at that place was no applied science or technical trouble.

The CEO blamed poor pilot training. Governments around the world grounded all the planes. Crunch communications experts criticized Boeing's handling equally dull, legalistic, and lacking empathy. Moreover, they noted that Boeing's stated values include interim with the highest ethical standards, taking personal responsibility, and valuing human life above all else, and that these should accept guided its response.

Crunch Management All-time Practice: Speak the Truth

Be upfront and transparent, and don't hibernate backside euphemisms or jargon. The truth will eventually go clear, and obfuscating volition merely cause farther mistrust and resentment.

Example: In a negative case study, United Airlines forcibly removed a 69-twelvemonth-quondam medico from an overbooked flight leaving Chicago in 2017. Security officers dragged him off the plane. A rider captured the scene on video and bystanders reported the officers threw the man against an armrest. The doctor later said he lost ii teeth and had a concussion and broken nose.

United CEO Oscar Munoz told employees past email the passenger had been "disruptive and belligerent." In a public statement, he said the airline had to "re-suit" the man, a euphemism for the process of removing a paying rider from the flight and then an airline employee could accept the seat.

The video of the doctor's crude treatment went viral on social media and showed that the doctor had not acted out equally Munoz claimed. United faced a wave of public anger, and its stock lost $1.4 billion in value. Munoz later apologized and promised the incident would not happen once more, but his planned promotion to United'southward chairman was canceled.

Crunch Management All-time Practice: Focus and Movement Alee

Give the crisis total attention, but do non lose sight of your future. Whenever possible, marshal your crisis response actions with the long-term vision and overarching goals of your organization.

Example: In early 2020, Delta Air Lines (like all carriers) faced a ending as a global pandemic virtually eliminated need for airline travel. While challenges persisted, the airline began working toward regaining financial stability.

CFO Paul Jacobson, who crafted and led Delta'south financial crunch response to the Sept. 11, 2001 attacks, canceled his announced retirement to assist rebuild the airline. To accomplish this job, Jacobson used strategies such as securing emergency government aid and deferring long-term capital spending.

Crunch Management Best Practice: Communicate Clearly

Present information openly and in a way that others tin understand. Recognize that personal perspective influences how everyone interprets information. Don't hide from bad news.

Example: In 1986, the Space Shuttle Challenger disintegrated little more a infinitesimal into flying, killing all seven crew members. Investigations establish the cause was the failure of an o-ring seal in a solid rocket booster that allowed pressurized burning gas to escape and cause structural disintegration.

Poor advice and controlling were determined to exist major contributing causes to the disaster. The investigating commission found the launch should not accept been canonical. They cited a lack of constructive communication between the decision-makers and the engineers, the absence of a formal communications channel which isolated management, and selective listening. The panel found the decision to continue with the launch was based on incomplete and misleading information.

Crisis Management Examples by Type: Social Media, Product Bug, and More

Crisis management case studies are especially instructive when y'all compare how ii organizations coped with relatively similar issues. The post-obit examples are organized around crisis type, including social media crises.

Examples of Social Media and PR Crisis Direction

Social media has enabled users to spread negative or embarrassing information about a brand in a nanosecond. Companies demand to monitor social media actively and act rapidly to address public relations problems. Unflattering episodes can go viral, severely damaging a company's reputation.

Examples of Good Social Media Crisis Direction

The most effective uses of social media to address company crises are typically characterized by speed and, when advisable, humor — although companies should also address underlying issues.

- Example: Popeye'southward

In 2019, Popeye's debuted a fried chicken sandwich that consumers praised on Twitter, comparison it favorably to rival Chick-fil-A'south offering. Chick-fil-A responded with a tweet promoting its sandwich as "the original." Popeye'southward shot back cheekily, "Y'all proficient?" The retort ignited the and then-chosen "chicken-sandwich wars," which Popeye'southward won as Americans flocked to its stores. - Case: Cerise Cantankerous

In 2011, the American Cherry Cross defused a crisis over a rogue tweet with humor. A staff member mistakenly sent a personal tweet to the system'southward account: "When we beverage we practice information technology correct #gettngslizzerd." As the tweet started to spread, Carmine Cross defused the PR nightmare with this tweet acknowledging the mistake: "We've deleted the rogue tweet simply rest assured the Red Cross is sober and we've confiscated the keys." A beer brand mentioned in the original tweet responded past asking its fans to donate to the Red Cross. - Example: Tide

In 2018, teenagers uploaded to social media videos of themselves eating Tide laundry detergent pods, which are poisonous, in the "Tide Pod Challenge." Rather than trying to ignore the controversy, manufacturer Procter & Hazard swung into action by lobbying social media platforms to remove the videos, mounting a communications entrada, and placing its own video of NFL role player Rob Gronkowski urging people non to swallow the pods on social media and broadcast television.

Examples of Bad Social Media Crunch Management

Crises can start or worsen on social media when brands display insensitivity or are tedious to react to growing negative engagement. Post-obit are some examples of companies that mishandled social media.

- Example: Gillette

In 2019, razor maker Gillette sought to promote the values of the #MeToo anti-sexual harassment move with a video that information technology placed on YouTube and in ads. After a century of promoting men who utilize its products as blastoff males and virile, the company in the video get-go showed men bullying and mansplaining, and so contrasted them with empathetic men who stop others from bad behavior toward women. Despite some scattered praise, the video got twice as many dislikes as likes on YouTube, and calls for a Gillette boycott arose. Twitter users bashed the company for negatively stereotyping men and shaming its customers. - Instance: Tinder

In 2015, dating app Tinder responded to a negative article about it in Vanity Fair mag with a 31-tweet rant. The tweets were defensive, included profanity, and a claim that the app had helped people in Due north Korea meet dates. The overreaction made Tinder the butt of jokes and drew negative attention to the visitor. - Case: Applebee'due south

In 2013, a waitress at eatery concatenation Applebee'south posted a customer'due south receipt on Reddit (with the name visible). The customer had written a critical comment about an automatic 18 percent tip added to the bill for a big party. Applebee's said on Facebook, "Nosotros wish this situation hadn't happened." Thousands of negative comments flooded in every hour. The story went viral, and Applebee's response was panned by PR experts as pouring gasoline on the fire. The company's social media team answered Twitter comments by copying and pasting its corporate policy argument, which users perceived as a snarky response. Then, failing to keep up with the flood of reaction, the visitor disabled user posts on its Facebook folio. Next, the team posted an update with the corporate argument, hiding the previous statement and more than 20,000 comments. Users perceived the tactic every bit deleting their posts, which enraged them.

Examples of Crisis Management Involving Product Problems

Product crises can exist peculiarly damaging for companies because their sales and brand are likely to endure. Effective crisis direction tin can ensure that the fallout is minimized. Poor crisis management can brand it worse.

Examples of Good Crisis Management of Production Issues

Companies that manage crises caused by faulty products well testify business organisation for customers, take responsibility for the issues, and respond decisively with improvements.

- Example: Mattel

In 2017, toy maker Mattel recalled near ii one thousand thousand toys that were tainted with outlawed lead paint. The human action angered parents and attracted regulator attention. The problem stemmed from a contract manufacturer that used paint not authorized by Mattel. Within a few days, Mattel identified the manufactory, halted production, and launched an investigation. The company voluntarily expanded its review and made 2 more production recalls, even adding an unrelated problem. The company imposed stringent new tests on products before they could be sold, changed suppliers, and put its own staff in contract manufacturing plants. Mattel communicated consistently and repeatedly apologized. The visitor won praise for its swift and honest response, and the visitor now enjoys a reputation of trustworthiness. - Case: Samsung

In 2016, Korean electronics company Samsung faced a crunch when its Galaxy Note vii smartphones exploded due to a bombardment trouble. Sales slumped as airlines banned passengers from carrying the phone on board. Samsung responded past immediately taking accountability, being transparent about not immediately knowing the cause, and vowing to determine the trouble. The company put 700 engineers on the problem and opened the research to third parties. When the problem was identified, the visitor communicated the issue clearly and introduced quality assurance and safety features. Samsung also launched a campaign aimed at tying its brand prototype to a larger purpose and improving its culture. In the next yr, Samsung's brand value rose ix percent, according to Interbrand, and its Galaxy S8 yielded record profits the following year.

Examples of Bad Crunch Management for Product Issues

Examples of poor crunch management past companies over product issues are often marked by slow acknowledgement or even denial.

- Example: Takata

Japanese auto parts maker Takata produced car airbags that exploded and were linked to at to the lowest degree 14 deaths. Governments recalled some 70 million airbags by 2017. Studies of the problem found pattern and engineering flaws. Before the extent of the problem became articulate, Takata did not desire to face embarrassment or prosecution. A senate report constitute that the visitor manipulated examination data and did not fairly address prophylactic concerns. The report concluded the company's prophylactic culture was broken. Takata ultimately went bankrupt with an estimated $15 billion in liabilities for recall and other costs. - Example: Nike

In 2019, U.South. star higher basketball player Zion Williamson sprained his genu when his Nike shoe broke, piddling more than than 30 seconds into a highly anticipated game. The crunch quickly gained the name "shoegate" in the media. The visitor's stock dropped $1.1 billion the next day, social media buzzed with jokes and jabs, and commentators described the incident equally a make failure. While the incident did not inflict long-lasting impairment on the company, Nike was panned for waiting for three hours to upshot a response. They stumbled by minimizing it equally an "isolated incident," while media reports pointed out four other recent similar shoe malfunctions.

Ameliorate Your Crisis Management Tactics with Real-Time Work Management in Smartsheet

Empower your people to become above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs modify.

The Smartsheet platform makes it easy to plan, capture, manage, and written report on work from anywhere, helping your team be more than constructive and become more done. Report on primal metrics and get existent-time visibility into piece of work equally it happens with coil-upwardly reports, dashboards, and automated workflows built to proceed your squad connected and informed.

When teams take clarity into the work getting done, at that place'due south no telling how much more they can accomplish in the same corporeality of fourth dimension. Try Smartsheet for free, today.

maldonadofars1954.blogspot.com

Source: https://www.smartsheet.com/content/crisis-management-examples

Post a Comment for "Should You Be Faced With a Crisis"